Rating Resolution 2025-2026

Adoption of the Annual Plan and Fees and Charges 2025-2026

Council Resolution 30 June 2025

1 The business paper on Adoption of the Annual Plan and Fees and Charges FY2025/26 be received.

2 Council adopts the Revenue and Financing Policy 2025 as presented without amendments.

3 Council adopts the Rates Remission Policy 2025 as presented without amendments.

4 Council adopts the Annual Plan 2025/26 document including fees and charges scheduled for 2025/26.

5 The Chief Executive be authorised to make any final editorial amendments to the Annual Plan 2025/26 document, and any changes directed by the Council at this meeting.

6 Pursuant to Sections 23 and 24 of the Local Government (Rating) Act 2002, Council set the rates, charges, and instalment due dates for the 2025/26 financial year commencing 1 July 2025 and ending on 30 June 2026 as follows:

- GENERAL RATE

A General Rate set under section 13 of the Local Government (Rating) Act 2002 (LGRA) made on every rating unit across the District, assessed as a rate per $100 of capital value. The General Rate is not set differentially. The General Rate will contribute to the funding of:

Leadership

Other Land and Buildings

District Libraries

Aquatic Centre

Les Munro Centre

Aerodrome

Public Facilities

Parks and Reserves

Elderly Persons Housing

Community Halls

Cemeteries

Community Development

Economic Development

District Promotion

Emergency Management

Regulatory Services

Waste Minimisation

Resource Management

Gallagher Recreation Centre

Requirement in 2025/26 (incl. GST)

|

General Rate |

Rate per $100 capital value |

Total Revenue Requirement ($000) |

|

All rating units in the District |

0.22791 |

10,849 |

- UNIFORM ANNUAL GENERAL CHARGE

A Uniform Annual General Charge (UAGC) per separately used or inhabited part of a rating unit across the District, set under Section 15(1)(b) of the LGRA. The UAGC will contribute to the funding of:

Leadership

Other Land and Buildings

District Libraries

Aquatic Centre

Les Munro Centre

Aerodrome

Public Facilities

Parks and Reserves

Elderly Persons Housing

Community Halls

Cemeteries

Community Development

Economic Development

District Promotion

Emergency Management

Regulatory Services

Waste Minimisation

Resource Management

Gallagher Recreation Centre

Requirement in 2025/26 (incl. GST)

|

Uniform Annual General Charge |

Charge per SUIP |

Total Revenue Requirement ($000) |

|

All rating units in the District |

$250 |

1,417 |

Definition of SUIP

A separately used or occupied part of a rating unit includes any part of a rating unit that is used or occupied by any person, other than the ratepayer, having a right to use or inhabit that part by virtue of a tenancy, lease, licence, or other agreement, or any part or parts of a rating unit that are used or occupied by the ratepayer for more than one single use. This definition includes separately used parts, whether or not actually occupied at any particular time, which are provided by the owner for rental (or other form of occupation) on an occasional or long-term basis by someone other than the owner.

For the avoidance of doubt, a rating unit that has only one use (i.e. does not have separate parts or is vacant land) is treated as being one SUIP.

- TARGETED RATES

Targeted Rates are set on categories of land defined by some factor, such as geographic location, provision of service, area or the use to which the land is put. The titles of ‘Targeted Rate’ (TR) and ‘Targeted Fixed Rate’ (TFR) are used by this Council. Targeted Fixed Rates are based on a uniform amount set per separately used or inhabited part of a rating unit (SUIP) or set per rating unit. Targeted Rates are assessed based on capital value or water consumption.

Targeted Rates Differentiated on Location

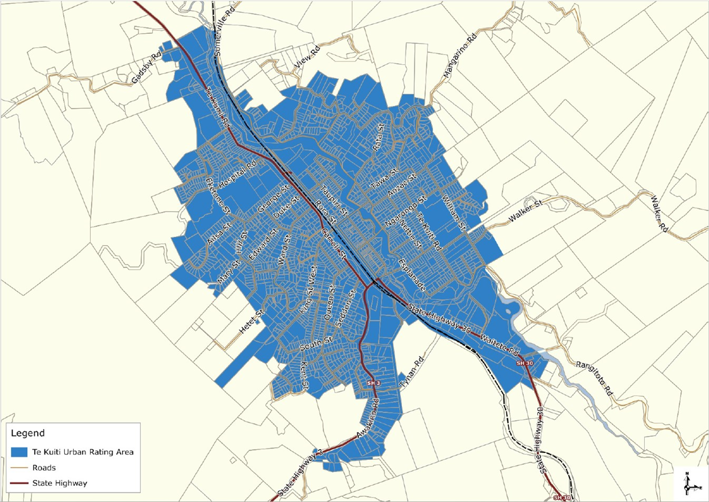

Council will use location (Schedule 2(6) LGRA) to define the land liable for the Piopio Retirement Village Contribution TFR, Rural Stormwater TFR, and Te Kuiti Urban Stormwater TFR and targeted rate.

The following location definitions for the respective rating areas and maps will apply:

|

Te Kuiti Urban Rating Area |

All rating units situated within the Te Kuiti Urban Rating Area (Refer to Revenue and Financing Policy for further details) |

|

Rural Rating Area |

All rating units situated within the Rural Rating Area (Refer to Revenue and Financing Policy for further details) |

|

Piopio Township |

All rating units connected or with the ability to connect to the Piopio Wastewater System (Refer to Revenue and Financing Policy for further details) |

|

Piopio Wider Benefit Rating Area |

All rating units situated in the rural areas around Piopio Township (excluding Rating units/SUIPs connected or with the ability to connect to the Piopio Wastewater System) that are deemed to indirectly benefit from the Piopio Wastewater reticulation network. (Refer to Revenue and Financing Policy for further details) |

TE KŪITI URBAN RATING AREA

RURAL RATING AREA

PIOPIO WIDER BENEFIT AREA

Differentials and factors of liability

Targeted rates may be set differentially, with different categories of land attracting a different level of rate. Council has chosen to differentiate the District Roading Rate into two categories and will use the ‘use to which the land is put’ to define land liable for these rates (schedule 2 (1) LGRA).

Differential Category Definitions

The following land use categories and differential factors will apply to the District Roading Rate:

District Roading Rate - General

All rating units in the district excluding those properties categorised as differential b) below.

The District Roading Rate – General category will have a differential factor of 1.0.

District Roading Rate -Forestry Exotic

Rating units that have been assigned the FE category code (Forestry Exotic) by Council’s Valuation Service Provider and/or properties that are partially used for exotic forestry.

The District Roading Rate – Forestry Exotic category will have a differential factor of 3.0.

Properties with a mixed use

Where rating units have a mixed use (e.g., pastoral and exotic forestry), and the area of exotic forestry is 20 hectares or more, the rating unit will be apportioned to enable the district roading rate to be charged correctly.

The portion used for exotic forestry will be charged the differential of 3.0 and the remaining portion will be charged the differential of 1.0.

3.1 District Roading Rates

Council set a TFR under section 16 of the Local Government (Rating) Act 2002 on every rating unit within the district differentiated on the basis of use. The TR will be assessed as a rate per $100 of capital value to part fund the Roads and Footpaths Activity. The rationale for use of this rate is contained in the Revenue and Financing Policy.

|

District Roading Rates (TR) |

Rate per $100 Capital Value |

Total Revenue Requirement ($000) |

|

District Roading Rate – General |

0.12546 |

5,777 |

|

District Roading Rate – Forestry Exotic |

0.37639 |

343 |

3.2 Piopio Retirement Village Contribution TFR

Council set a TFR under section 16 of the Local Government (Rating) Act 2002 per rating unit situated within the Piopio Township and the Piopio Wider Benefit Rating Area to fund the support of the continued delivery of elderly housing accommodation services provided by the Piopio Retirement Trust Board through the remission of service charges.

Requirement in 2025/26 (incl. GST)

|

Piopio Retirement Village Contribution (TFR) |

Charge per Rating Unit |

Total Revenue Requirement ($000) |

|

Piopio Wider Benefit Rating Area and Piopio Township |

$24 |

18 |

3.3 Rural Stormwater TFR

Council set a TFR under section 16 of the Local Government (Rating) Act 2002 per separately used or inhabited part of a rating unit in the Rural Rating Area of the District to fund the Rural Stormwater Activity.

Requirement in 2025/26 (incl. GST)

|

Rural Stormwater (TFR) |

Charge per SUIP |

Total Revenue Requirement ($000) |

|

Rural Rating Area |

$22 |

76 |

3.4 Te Kuiti Urban Stormwater TFR and Targeted Rate

(i) Council set a TFR under section 16 of the Local Government (Rating) Act 2002 per rating unit in the Te Kuiti Urban Rating Area to partly fund the Te Kuiti Urban Stormwater Activity.

(ii) Council set a Targeted Rate under section 16 of the Local Government (Rating) Act 2002 to partly fund the Te Kuiti Urban Stormwater Activity, to be assessed as a rate per $100 of Capital value on every rating unit in the Te Kuiti Urban Rating Area excluding those in respect of which there is a current resource consent to discharge stormwater into the Mangaokewa Stream, and so are not using any part of the urban reticulated stormwater or drainage network.

Requirement in 2025/26 (incl. GST)

|

Te Kuiti Urban Stormwater (TFR) |

Charge per rating unit |

Total Revenue Requirement ($000) |

|

Te Kuiti Urban Rating Area |

$193 |

355 |

|

Te Kuiti Urban Stormwater Targeted Rate (TR) |

Rate per $100 Capital Value |

Total Revenue Requirement ($000) |

|

Te Kuiti Urban Rating Area (excluding rating units not using network) |

0.08108 |

632 |

3.5 Water Supply Rates

Council set a TFR under section 16 of the Local Government (Rating) Act 2002 for Water Supply differentiated on the basis of supply area. The TFR is set per separately used or inhabited part of a rating unit within Te Kuiti and Rural Communities (Piopio, Maniaiti/Benneydale and Mokau), with liability calculated based on whether the SUIP is connected, or merely serviceable (Serviceable means the rating unit is within 100m of water main and practicably serviceable in the opinion of Council).

Requirement in 2025/26 (incl. GST)

|

Water Supply (TFR) |

Charge |

Total Revenue Requirement ($000) |

|

|

Per connected SUIP |

Per serviceable SUIP |

||

|

Te Kuiti |

$966 |

$483 |

2,079 |

|

Piopio |

$1,356 |

$678 |

337 |

|

Maniaiti/Benneydale |

$1,356 |

$678 |

170 |

|

Mokau |

$1,356 |

$678 |

302 |

3.6 Extraordinary Water Supply Rate

Council set a TR under section 19 of the Local Government (Rating) Act 2002 per cubic metre of water consumed over and above an annual consumption of 292m3 per SUIP, differentiated by supply area that has been fitted with a water meter and/or is defined as having an extraordinary supply (in accordance with Council’s Water Services Bylaw). The rates are:

Requirement in 2025/26 (incl. GST)

|

Water Supply Rate (TR) |

2025/26 Charge per cubic metre (including GST) above 292m3 |

|

Te Kuiti |

$4.61 |

|

Piopio |

$5.03 |

|

Maniaiti/Benneydale |

$5.55 |

|

Mokau |

$7.37 |

|

Total Revenue Requirement ($000) |

$1,553 |

Metered Water Supply Due Dates

|

|

Reading Period |

Due Date |

|

Te Kuiti Meat Companies |

Monthly |

15th of the month following invoice |

|

Te Kuiti, Piopio, Mokau and Maniaiti/Benneydale |

Jul – Dec 2025 Jan – Jun 2026 |

15th of the month following invoice |

3.7 District Wide Benefit Rate for Water Supply

Council set a TFR under section 16 of the Local Government (Rating) Act 2002 on every rating unit within the district to part fund the water supply activities.

Requirement in 2025/26 (incl. GST)

|

District Wide Benefit Rate for Water Supply (TFR) |

Charge per Rating Unit |

Total Revenue Requirement ($000) |

|

All Rating Units in the District |

$40 |

184 |

3.8 Wastewater Rates

Council set a TFR under section 16 of the Local Government (Rating) Act 2002 to provide for the collection and disposal of sewage. The TFR is set per separately used or inhabited part of a rating unit within the district, with liability calculated based on whether the SUIP is connected to the wastewater network, or merely serviceable (Serviceable means the rating unit is within 30m of sewer reticulation and practicably serviceable in the opinion of Council).

Requirement in 2025/26 (incl. GST)

|

Wastewater (TFR) |

Charge |

Total Revenue Requirement ($000) |

|

|

Per connected SUIP |

Per serviceable SUIP |

||

|

Te Kuiti (Residential only) |

$1,300 |

$650 |

2,286 |

|

Maniaiti/Benneydale (Residential and Non-residential) |

$1,300 |

$650 |

151 |

|

Te Waitere (Residential and Non-residential) |

$1,300 |

$650 |

26 |

|

Piopio (Residential and Non-residential) |

$1,300 |

$650 |

273 |

3.9 Wastewater rates for non-residential properties in Te Kuiti

For all non-residential properties in Te Kuiti, Council set a TFR under section 16 of the Local Government (Rating) Act 2002 per SUIP set on a differential basis based on the following Categories:

• Category 1 - All Businesses

• Category 2 - Education & Community Childcare, Places of Worship, Marae, Clubs and Societies and Emergency Services. This category consists of organisations that are generally deemed ‘not for profit’. For avoidance of doubt, Category 2 only covers properties with uses listed within this category and no others.

• Category 3 - Government Department use, Rest Homes and Hospitals.

All non-residential SUIPs will be charged one base charge for up to four pans and per pan (Pan Charge) for every pan over and above this threshold on the following basis:

Base Charge:

Requirement in 2025/26 (incl. GST)

|

Non- Residential Targeted Rate (TFR) |

Base Charge per SUIP (up to 4 pans) |

Per serviceable SUIP |

Total Revenue Requirement ($000) |

|

Category 1 |

$650 |

$650 |

132 |

|

Category 2 |

$650 |

$650 |

29 |

|

Category 3 |

$1,300 |

$650 |

22 |

Pan Charge:

Requirement in 2025/26 (incl. GST)

|

Non- Residential Targeted Rate (TFR) |

Number of pans |

Charge per pan (Pan Charge) |

Total Revenue Requirement ($000) |

|

Category 1 |

5th pan and over |

$910 |

94 |

|

Category 2 |

5-10 Pans |

$390 |

6 |

|

Over 10 Pans |

$260 |

31 |

|

|

Category 3 |

5th pan and over |

$910 |

56 |

3.10 Trade Waste Contribution TFR

Council set a Trade Waste Contribution TFR under section 16 of the Local Government (Rating) Act 2002 per rating unit in the District in recognition of the contribution made to the social and economic well-being of the District by the large industrial users of the Te Kuiti Wastewater Network.

Requirement in 2025/26 (incl. GST)

|

Trade Waste Contribution (TFR) |

Charge Per rating unit |

Total Revenue Requirement ($000) |

|

All Rating Units in the District |

$42 |

194 |

3.11 District Wide Benefit Rate for Wastewater

Council set a TFR under section 16 of the Local Government (Rating) Act 2002 on every rating unit within the District to part fund the wastewater activities.

Requirement in 2025/26 (incl. GST)

|

District Wide Benefit Rate for Wastewater (TFR) |

Charge Per Rating Unit |

Total Revenue Requirement ($000) |

|

All rating units in the District |

$43 |

198 |

3.12 Solid Waste Collection Rate

Council set a TFR under section 16 of the Local Government (Rating) Act 2002 per separately used or inhabited part of a rating unit to which Council provides a kerbside collection and recycling service differentiated by service areas where Council operates kerbside collection and kerbside recycling services (Te Kuiti, Piopio, Mokau (including Awakino) communities and Waitomo Village and some surrounding parts).

Requirement in 2025/26 (incl. GST)

|

Solid Waste Collection (TFR) |

Charge per SUIP |

Total Revenue Requirement ($000) |

|

Te Kuiti |

$71 |

150 |

|

Waitomo |

$76 |

52 |

|

Piopio |

$160 |

38 |

|

Mokau |

$174 |

49 |

3.13 Solid Waste Rate

Council set a TFR under section 16 of the Local Government (Rating) Act 2002 per separately used or inhabited part of a rating unit District wide to part fund the Solid Waste activity.

Requirement in 2025/26 (incl. GST)

|

Solid Waste (TFR) |

Charge per SUIP |

Total Revenue Requirement ($000) |

|

All rating units in the District |

$330 |

1,828 |

4. RATES PAYMENTS

Rates will be payable in four equal instalments with the due dates for payments being:

1st Instalment 29 August 2025 (Friday)

2nd Instalment 28 November 2025 (Friday)

3rd Instalment 27 February 2026 (Friday)

4th instalment 29 May 2026 (Friday)

Note: The due date for payment of each instalment is the last working day in each of the months specified above. Rates payments will be allocated to the oldest debt first.

5. RATES REMISSIONS AND POSTPONEMENTS

Council has developed a rates remissions policy as per LGA (section 102 (3)(a), 108 and 109) and LGRA (Section 85). Remission categories include Properties Used Jointly as a Single Unit, Community Organisations and Clubs and Societies, Organisations Providing Care for the Elderly, New Residential Subdivisions, Māori Freehold Land, Cases of Land Affected by Natural Calamity, Cases of Financial Hardship, New Businesses, Penalties, and Rates and/or penalties following a Rating Sale or Abandoned Land Sale. The estimated value of these remissions is $180,500 (excluding GST) for the 2025/26 year.

Under the Policy on Remission of Rates, Council will not offer any permanent postponements of rates.

6. PENALTIES

Pursuant to sections 57 and 58 of the Local Government (Rating) Act 2002, Council may apply penalties as follows:

(a) A penalty charge of 10 percent (10%) on any part of an instalment that has been assessed for the financial year commencing 1 July 2025 and which remains unpaid after 5pm on the due date for payment of that instalment, to be added on the penalty dates below:

Instalment 1 2 September 2025

Instalment 2 2 December 2025

Instalment 3 3 March 2026

Instalment 4 4 June 2026

(b) A further penalty charge of 10 percent (10%) on any part of any rates assessed before 1 July 2025 that remains unpaid on 1 July 2025, to be added on 7 July 2025.

(c) No penalties will be charged where a ratepayer is paying rates by direct debit or where there is an approved payment arrangement in place.